XRP Price Prediction: Analyzing the Path to $3 and Beyond Amid Market Shifts

#XRP

- Technical Consolidation: XRP is trading near its 20-day moving average with a slightly bullish MACD, suggesting a potential breakout above $2.90 could lead to a test of $3.10.

- Fundamental Strength: Positive developments in cross-border utility (BRICS, Africa expansion) and increased on-chain activity provide a solid foundation for price appreciation, countering negative narratives.

- Regulatory and Selling Pressure: Updated US regulations and significant weekly selling ($500M) present headwinds, making a sustained move above $3.10 contingent on overcoming these pressures.

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Moving Average

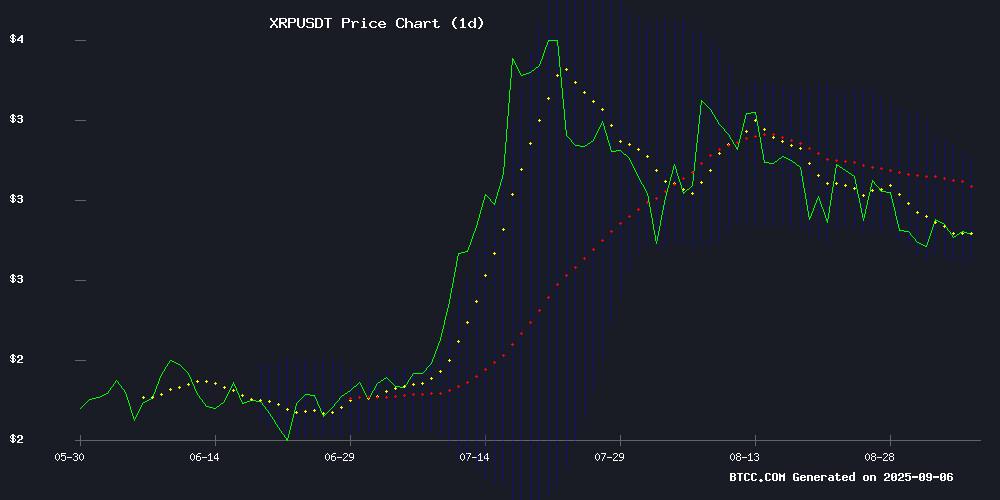

XRP is currently trading at $2.8084, slightly below its 20-day moving average of $2.8988, indicating potential short-term resistance. The MACD reading of 0.1213 versus 0.1183 shows a marginal bullish crossover with a histogram of 0.0030, suggesting cautious Optimism among traders. Bollinger Bands position the price between $3.1009 (upper) and $2.6967 (lower), with the middle band aligning with the 20-day MA. According to BTCC financial analyst Mia, 'XRP is consolidating within a tight range, with the MACD hinting at building upward momentum. A sustained break above the 20-day MA could trigger a move toward the upper Bollinger Band around $3.10.'

Market Sentiment: Positive Developments Offset Regulatory Concerns

Recent news presents a balanced yet cautiously optimistic outlook for XRP. Positive developments include BRICS highlighting XRP Ledger for cross-border trade, Ripple expanding its RLUSD stablecoin in Africa, and significant German media coverage. However, updated US Senate regulations and substantial weekly selling pressure ($500 million) introduce headwinds. BTCC financial analyst Mia notes, 'The fundamental narrative for XRP remains strong with real-world utility gains, but regulatory developments and large-volume selling require monitoring. The surge in on-chain activity effectively counters the ‘ghost chain’ criticism, supporting long-term value.'

Factors Influencing XRP’s Price

BRICS Report Highlights XRP Ledger for Cross-Border Trade Solutions

The XRP Ledger has gained formal recognition in official BRICS documentation as a potential solution for cross-border trade. The report specifically cites its escrow model as an automated payment mechanism, marking a significant endorsement from an economic bloc representing 40% of the global population.

Crypto researcher SMQKE uncovered references to the XRP Ledger in BRICS documents, which explore blockchain applications for trade finance. The technology's ability to facilitate VIRTUAL escrow accounts—ensuring funds are released upon meeting contractual conditions—positions it as a key component of the BRICS Pay initiative.

BRICS Pay aims to create decentralized blockchain payment frameworks, reducing reliance on SWIFT and the US dollar. The XRP Ledger, operational since 2012, processes transactions rapidly at minimal cost, making it a viable candidate for integration into this system.

Ripple Expands RLUSD Stablecoin Footprint in Africa Through Strategic Fintech Partnerships

Ripple is aggressively positioning its USD-backed stablecoin RLUSD for African adoption through partnerships with major fintech platforms Chipper Cash, VALR, and Yellow Card. The move grants immediate access to millions of existing users across the continent, bypassing the need to establish consumer trust from scratch.

With a $710 million market cap since its 2024 launch, RLUSD remains dwarfed by leading stablecoins but shows institutional traction. Chipper Cash CEO Ham Serunjogi framed the integration as a catalyst for "institutional blockchain adoption" rather than retail speculation.

Notably, Ripple is testing humanitarian applications for RLUSD—a strategic play in a region where remittances account for over 9% of GDP in some nations. The stablecoin's infrastructure could streamline cross-border flows while circumventing traditional banking bottlenecks.

US Senate Tightens Crypto Regulations in Updated Financial Innovation Act

The US Senate has introduced a critical amendment to the Responsible Financial Innovation Act of 2025, explicitly barring tokenized stocks from being classified as commodities. This legislative MOVE aims to eliminate regulatory arbitrage opportunities for blockchain-based equity tokens.

Senator Cynthia Lummis (R-WY) emphasized the urgency of finalizing the bill during recent comments to CNBC. The Senate Banking Committee plans to vote on SEC-related provisions this month, with the Agriculture Committee addressing CFTC matters shortly thereafter. The accelerated timeline targets presidential approval before year-end.

The regulatory clarification carries significant implications for major crypto entities like Coinbase and Ripple, particularly regarding securities classification. This development follows July's stablecoin legislation and comes as Congress reconciles differing House and Senate versions of market structure reforms.

How Realistic Is Air China’s XRP Payment Integration Plan?

Air China's PhoenixMiles loyalty program, serving over 60 million members, is expanding payment options through a partnership with Nasdaq-listed Webus International. The collaboration includes Wetour, a travel platform that will support XRP payments for overseas services like airport transfers and chauffeur bookings.

This marks a rare instance of a Chinese state-owned enterprise flirting with cryptocurrency integration. Yet Beijing's strict ban on crypto transactions means Air China cannot legally adopt XRP for domestic operations. The airline, majority-owned by government-supervised China National Aviation Holding, must limit its digital asset ambitions to cross-border services.

The carefully worded announcement conspicuously avoids confirming XRP's use for Core airline services. Market observers note the strategic ambiguity—while the partnership signals institutional interest in crypto payments, regulatory constraints force measured implementation.

XRP Unlikely to See 90% Crash Again Amid Structural Market Shifts, Says Digital Ascension CEO

Jake Clover, CEO of Digital Ascension Group, asserts that XRP will not revisit a 90% price collapse, citing fundamental changes in market dynamics. "I WOULD love it too. I don’t think it’s going to happen," Clover remarked in a September 3 video, emphasizing that prolonged sub-$1 levels provided ample accumulation opportunities. Skeptics who hesitated at $0.30-$0.50 may have missed their window.

The shift is attributed to institutional demand mechanisms like TWAP/VWAP algorithms and anticipated spot ETF approvals, with Bloomberg Intelligence estimating a 95% likelihood by 2025. These factors create persistent buy-side pressure that Clover believes will sustain prices: "They’re not letting it come back down." The analysis frames recent price action as a successful stress test of XRP's new market microstructure.

Nearly $500 Million XRP Sold This Week, But Critical Holders Act As Saviour

Exchange balances of XRP have surged sharply over the past week, with nearly 170 million tokens—worth approximately $483 million—moved to exchanges. Such inflows typically signal selling activity, reflecting growing caution among retail investors as XRP struggles to maintain upward momentum.

Despite the bearish sentiment, long-term holders are stepping in to accumulate XRP at current levels. Their buying activity provides a critical support layer, absorbing selling pressure and stabilizing the market. This divergence between short-term traders and committed investors underscores the ongoing battle between fear and conviction in XRP's future.

XRP Defies 'Ghost Chain' Label with Surge in On-Chain Activity

XRP continues to silence critics as the token demonstrates resilience amid ongoing skepticism. The XRP Ledger has processed an average of 819 daily transactions valued at over $280,000 each, countering claims of inactivity. Whale activity remains subdued during this consolidation phase, with no significant large transactions recorded in September.

SWIFT Chief Innovation Officer Tom Zschach recently dismissed Ripple as 'a dead chain walking,' citing concerns over centralized governance and lack of regulatory clarity. Yet XRP's persistent on-chain activity suggests otherwise, even as institutional adoption hurdles remain.

Ripple CEO Highlights Key Facts About XRP and RLUSD

Ripple CEO Brad Garlinghouse recently endorsed a post outlining five critical facts about XRP and the company's stablecoin, RLUSD. The post, shared on X, emphasizes XRP's established role in cross-border payments and remittances, a use case that continues to grow. The XRP Ledger ecosystem, extending beyond Ripple's CORE operations, now encompasses DeFi, NFTs, and asset tokenization, with hundreds of projects leveraging its infrastructure.

RLUSD, Ripple's institutional-focused stablecoin launched in late 2024, has rapidly gained traction, surpassing a $700 million market cap within a year. Its adoption in significant deals underscores its utility in institutional finance. The community remains keenly interested in the potential for XRP spot ETFs, though no timeline has been provided.

Germany’s Biggest TV Channel Features Ripple, XRP On Air

Ripple and its native token XRP gained rare mainstream exposure on German finance channel Der Aktionar TV. David Hartmann of Vontobel discussed XRP's role in global banking, highlighting its utility as a bridge currency for cross-border payments. The segment emphasized how XRP reduces transaction costs and settlement times by eliminating intermediate currency conversions.

Legal clarity from Ripple's SEC case victory has bolstered institutional confidence. Hartmann positioned Ripple as a service provider challenging dollar dominance in international transfers. The coverage signals growing media recognition of XRP's banking infrastructure potential.

Ripple Price Analysis: XRP Struggles to Break Consolidation as Technicals Signal Potential Downside

XRP remains trapped in a descending wedge pattern, with its failure to break consolidation signaling potential trouble ahead. The token hovers NEAR the $2.8-$2.9 range, precariously balanced above the 100-day moving average support at $2.7. A breakdown could trigger a slide toward $2.4, while holding this level may set the stage for a retest of wedge resistance near $3.1-$3.2.

The 4-hour chart reveals weakening momentum as XRP repeatedly tests the wedge's lower boundary. Market participants await a decisive breakout—clearing $3.1 could propel prices toward $3.4, but sustained weakness may confirm a return to the $2.7 decision zone. The compression suggests an impending volatility expansion, with the wedge's resolution likely determining XRP's medium-term trajectory.

Pundit Urges XRP Holders to Stay Committed Amid Market Volatility

XRP's recent surge toward its 2017 all-time high has reignited Optimism among crypto investors. The altcoin's performance this cycle stands out from previous market movements, suggesting potential for extended gains.

Crypto analyst Pumpius has advised XRP holders to maintain their positions despite market turbulence. "The waiting. The ridicule. The endless manipulation of the charts," he acknowledged in a social media post, praising long-term holders for their resilience.

Market observers note XRP's current cycle appears fundamentally different from past patterns. The asset's ability to weather criticism and volatility while maintaining upward momentum has drawn attention from both retail and institutional investors.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP has the potential to reach the upper Bollinger Band at approximately $3.10 in the near term, representing a ~10% increase from its current price of $2.8084. Key resistance lies at the 20-day moving average of $2.8988. Breaking above this level with volume could catalyze further gains.

Fundamental factors are generally supportive. Strategic partnerships, especially in cross-border payments and stablecoin expansion, enhance XRP's utility narrative. However, regulatory updates and large selling volumes ($500 million this week) pose short-term risks. BTCC financial analyst Mia emphasizes, 'While a 90% crash is unlikely due to structural market shifts, investors should expect volatility. The $3.10 level is a realistic initial target, with a break above potentially opening a path toward $3.50.'

| Price Level | Significance | Probability |

|---|---|---|

| $2.70 (Bollinger Lower) | Strong Support | High |

| $2.90 (20-Day MA) | Immediate Resistance | Medium |

| $3.10 (Bollinger Upper) | Near-Term Target | Medium |

| $3.50+ | Bull Breakout Target | Low (Near Term) |